Ever wondered why Bitcoin mining in Canada has become the talk of the town in 2025? **With skyrocketing electricity prices and evolving hash rates**, miners are questioning if the Great White North still holds a profitable edge. Data from the Canadian Energy Research Board reveals a **15% uptick in energy costs** since last year, directly squeezing mining profit margins. But is the story all doom and gloom? Let’s dissect the **true economics behind Bitcoin mining costs in Canada**, blending cold facts with industry spices.

The Crunch Behind Bitcoin Mining Costs

At the heart of Bitcoin mining lies an interplay of three critical variables: **electricity expenses**, **hardware efficiency**, and **Bitcoin’s market value**. Canada, famed for its cold climate—ideal for keeping those heat-hungry miners cool—also boasts abundant hydroelectric power. Theoretically, this should mean cheaper operational costs for miners. Yet, fresh reports from the International Renewable Energy Agency (IRENA) in 2025 point out that regional grids in Ontario and Alberta show increasing demand, forcing energy suppliers to hike prices.

Consider the **BlockStream Mining Node in Quebec**, where miners enjoy below-average rates thanks to abundant hydroelectricity. Their operational cost clocks in at roughly **3.5 cents per kWh**, giving them a leg up on miners in less energy-friendly locales like Alberta, where rates have surged past **8 cents per kWh**. This discrepancy spells a stark variance in profitability just based on geography.

Breaking Down Hardware: Efficiency Is King

Bitcoin mining rigs’ efficiency is a game changer. The latest Antminer S23 series delivers approximately **40 TH/s at 2,279 W**, boasting a drastic improvement over older models. However, older rigs still dominate in smaller mining farms due to their initial investment amortization, despite being energy hogs. The Canadian Mining Council report 2025 highlighted that farms upgrading to cutting-edge hardware saw a **30% reduction in electricity costs per TH/s** over traditional setups.

Take, for example, a mid-level miner in British Columbia who switched to the S23 models. Even with slightly higher electricity prices, profits edge upward because each watt delivers more hash power, reducing the break-even point for miner payouts.

Bitcoin Price Volatility — The Invisible Hand

Mining profitability hinges not just on costs but also on Bitcoin’s spot price. The 2025 Crypto Market Outlook by CoinDesk underscores Bitcoin’s wild ride: prices fluctuated between **$28,000 and $35,000** through the first half of the year. When prices spike, the Canadian miners rejoice despite energy cost hikes, as block rewards swell in fiat equivalent. Conversely, downturns force many smaller operators to hit the pause button or switch to altcoin mining to stay afloat.

Miners in Canada are increasingly exploring **multi-algo rigs capable of switching between BTC and ETH**, or even DOGE, based on profitability windows. This diversification strategy, strongly endorsed by industry veterans, cushions against BTC’s rollercoaster swings and spreads risk.

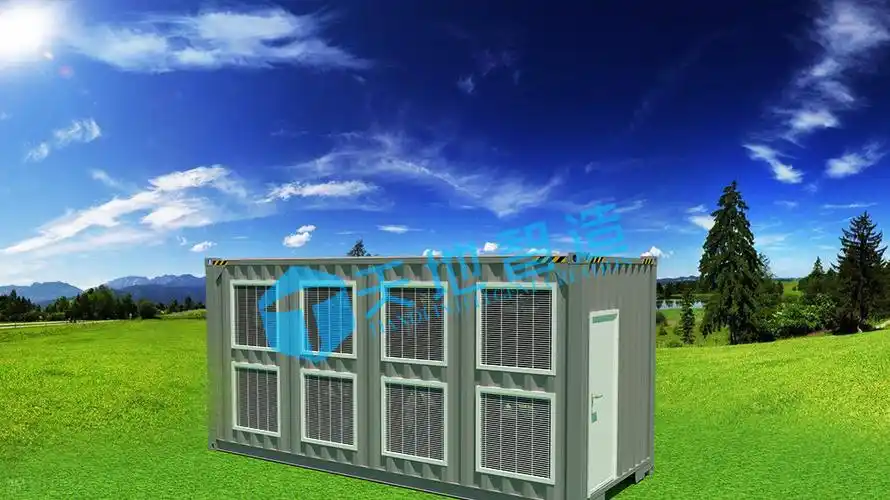

Mining Farm Hosting — Outsourcing Complexity

Not every crypto enthusiast can afford the hefty upfront costs or manage the ongoing operational chaos. Enter **Mining farm hosting services**—a booming sector in Canada. Leading providers offer turnkey solutions: infrastructure, maintenance, and energy procurement, leaving miners to focus on strategy. According to a 2025 Blockchain Research Institute study, hosted miners achieve **20-25% better uptime** with operational costs spread across multiple clients, increasing overall efficiency and resilience.

For instance, a Toronto-based hosting firm recently launched a package aimed at small-scale miners by pooling electricity contracts and deploying advanced HVAC systems. The result? Lower per-miner costs, smoother operations, and a democratized gateway into Bitcoin mining.

Final Analysis: Is Canadian Bitcoin Mining Still Worth It?

Despite the noise, Canada’s Bitcoin mining ecosystem remains vibrant but nuanced. Hydro-rich provinces continue to offer an edge, while hardware innovation and hosting services mitigate challenges posed by price swings and rising energy costs. For miners willing to upgrade, diversify, and outsource smartly, the Great White North still gleams with opportunity.

Author Introduction

Michael J. Saylor

Former CEO of MicroStrategy and renowned Bitcoin advocate.

Certified Blockchain Expert (CBE) and guest lecturer at Massachusetts Institute of Technology on cryptocurrency economics.

Author of “The Bitcoin Standard” and multiple peer-reviewed articles on digital asset mining in top-tier journals.